"Leaky Roof? Get It Fixed Fast – Book a Free Inspection Today!"

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Are you tired of hearing that [Common Belief] is the only way to achieve [Desired Result]? What if we told you there’s a faster, simpler way to get the results you want, without the stress and hassle of [Common Belief]?

Licensed & Insured Roofing Experts

Lifetime Warranty on Materials

Fast, Free, No-Obligation Inspections

Certified Roofing Company

Dallas Fire Insurance Claim?

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Get The Maximum Settlement You Deserve In Minimum Time

Our licensed public adjusters work exclusively for Policyholders,

not the insurance company.

Fire Claim Experts

Licensed Insurance Policyholder Advocates

500+ Satisfied Policyholders and Counting

Non-Litigious Solutions

Over $250,000,000 Recovered

INSURANCE COMPANIES HAVE EXPERTS WORKING FOR THEM. YOU SHOULD, TOO!™

Recover Faster, Settle Smarter

Avoid costly mistakes on your Dallas fire insurance claim.

Discover why hiring ICRS Public Adjusters at the start of your claim process leads to faster, higher settlements for commercial and apartment property owners.

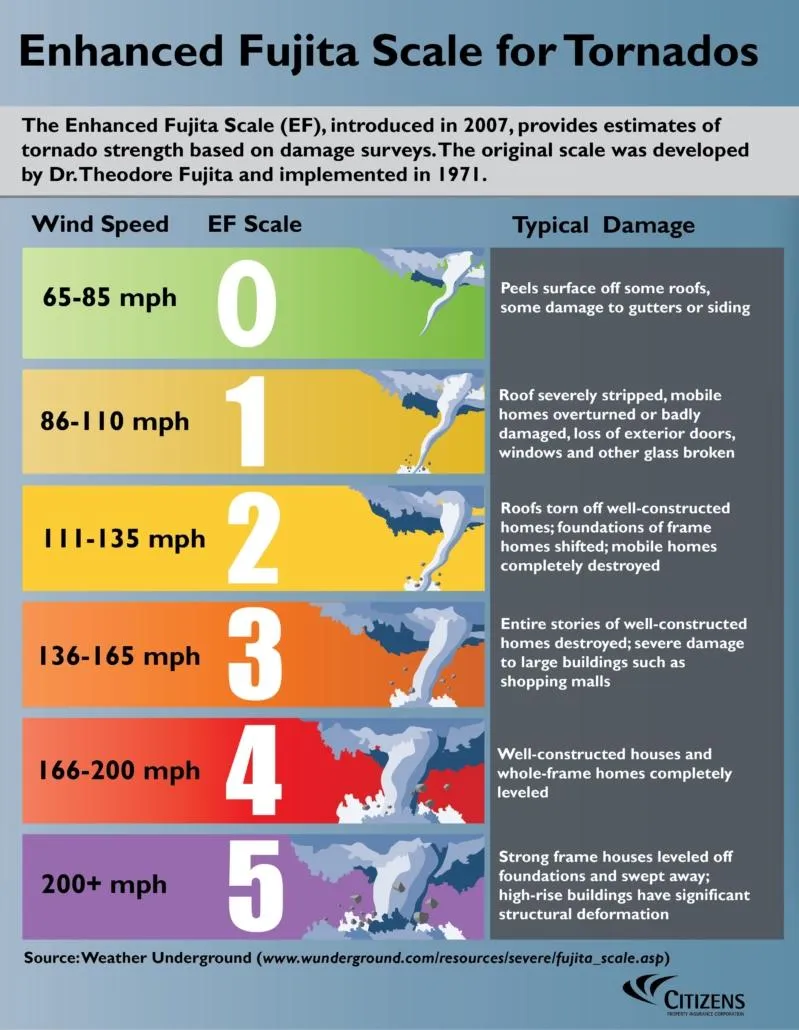

Don’t Settle for Less — Trusted Large-Loss Tornado Insurance Claim Public Adjusters

Texas Tornado Damage Claim?

Maximize Your Insurance Recovery.

We help Texas property owners recover maximum settlements after devastating tornado damage. Our licensed public adjusters work exclusively for you, not the insurance company.

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Fast, Free, No-Obligation Inspections. We’ll Be in Touch Within 24 Hours!

20+

Years Of Experience

500+

Large-Loss Claims Settled

130,160

Hours Worked

$450,000

Average Claim Amount

Expert Tornado Damage Claim Assistance

NOAA Storm Events Database

Description: The National Centers for Environmental Information (NCEI) maintains the most authoritative database of severe weather reports, including all tornadoes in Texas.

Features: Searchable by state, event type, date range, and more.

Link: NOAA Storm Events Database – Texas Tornado Reports

National Weather Service (NWS) Local Forecast Offices

Each local NWS office covers a specific region in Texas and publishes tornado summaries, maps, and surveys.

Notable NWS Office Pages:

NWS Fort Worth/Dallas: https://www.weather.gov/fwd/

NWS Houston/Galveston: https://www.weather.gov/hgx/

NWS Lubbock: https://www.weather.gov/lub/

NWS Austin/San Antonio: https://www.weather.gov/ewx/

You can find “Event Summaries” or “Storm Surveys” for detailed tornado reports by date or event.

SPC (Storm Prediction Center) Tornado Database

Description: Maintains tornado data going back to 1950.

Link: SPC Tornado Archive Tool

Recent Tornado Events in Texas

June 5–6: Lubbock and West Texas

A powerful storm system produced over a dozen tornadoes west of Lubbock, with wind gusts reaching up to 109 mph and hail the size of grapefruits.

June 8–9: Abilene and West-Central Texas

Severe overnight storms caused significant damage in Abilene, including the partial destruction of local news station KTXS.

The storms brought heavy rain, large hail, lightning, and wind gusts exceeding 80 mph.

While no tornadoes have been confirmed, the National Weather Service attributes the majority of structural damage to intense straight-line winds.

May 18–21: Central and North Texas

A major tornado outbreak occurred across the Great Plains and Mid-South regions, with Texas experiencing significant impacts.

In Gordon, Texas, an EF1 tornado caused widespread tree and power pole damage, along with partial roof loss on several homes.

Significant damage occurred at the town's high school stadium and nearby athletic fields.

Four people were injured.

April 24–25: Central Texas and Panhandle

A severe weather system spawned over 16 tornadoes across six states, with 10 reported in Texas alone.

Large hail of over 4.5 inches was also reported in multiple areas as storms passed over the Central and Southern Plains.

Apartment & Multifamily Tornado Damage Claims

Tornado damage in apartment complexes and homeowner associations present unique challenges with multiple units affected. We handle complex multifamily tornado claims and work to protect both property owners and management companies. From mitigation resources, structure damage settlement negotiations, and business interruption losses, you can count on us.

Common Tornado Damage Claim Issues

Roof and structural damage

Broken windows and doors

Commercial Building

Tornado Damage Claims

We specialize in complex commercial tornado claims involving building damage, business interruption, inventory loss, equipment damage, and resources to help assess your liablity. Our adjusters understand the unique challenges businesses face after tornado damage. Put our experience to work for you in getting back to business fairly and promptly!

Common Tornado Damage Claim Issues

Equipment or machinery loss

Business interruption and loss of rental income

Luxury Home Tornado Damage Claims

When a tornado strikes a luxury property, standard claim handling isn't sufficient. Our specialized high-value home team understands the unique materials, custom features, and irreplaceable items that simply are not "standard grade" in most insurance company's estimating software to properly indemnify custom home residences.

Common Tornado Damage Claim Issues

Interior water damage from exposure

Debris removal and cleanup

Struggling With?

Initial Tornado Damage Claims

When a tornado damages your commercial, multifamily, or residential property, your first move is critical. Filing a large-loss insurance claim is high-stakes and early guidance from an ICRS public adjuster can make all the difference. By hiring our licensed tornado claim experts from day one, you avoid costly mistakes, accelerate recovery, and gain a strategic edge to maximize your settlement.

Underpaid Tornado Damage Claims

After a loss, you count on your insurance company to cover the full cost of restoring your property and business.

But too often, insurance claims are underpaid, leaving property owners with a financial shortfall.

We routinely represent policyholders to re-open and supplement underpaid claims.

Denied Tornado Damage Claims

Don't let a denial letter discourage you. Tornado insurance claims are often denied unfairly, leaving policyholders overwhelmed, frustrated, and unsure of what to do next.

Get a 2nd opinion before accepting a denial.

We specialize in overturning wrongfully denied tornado claims and fight to get the settlement you deserve.

Delayed Tornado Damage

Claims

Is your claim stuck in limbo? Being ignored?

Unfortunately,

delayed insurance claims are all too common and costly.

Get unstuck!

We'll push for a swift resolution and get your claim settled pursuant to your policy and statutes.

Large Loss Fire Claim Experts

Dallas Fire Claim Denied or Underpaid?

If your claim has been delayed, denied, or lowballed, it's time to take action. Insurance carriers often dispute large-loss commercial, multifamily and custom home fire damage claims-but we have the expertise to prove the real extent of your losses.

Public Adjusters for Commercial Buildings and Apartment Complex Fire Damage Insurance Claims.

We Fight Insurance Tactics That Reduce Payouts.

Helping Policyholders Recover Full Indemnity.

Fire Insurance Claim Experts

Dallas' Premier Commercial Fire Damage Claim Experts

Facing a complex commercial fire claim? Our IICRC-certified professionals expertly document smoke, heat, and water damage that insurance companies routinely minimize. We ensure Dallas business owners recover maximum policy benefits with comprehensive documentation that insurance adjusters can't dispute.

Industry-Leading Specialists in Business Interruption & Property Damage Recovery

We Overturn Denied & Underpaid Fire Insurance Claims

Forensic Fire Assessments That Support Your Claim

35 + Successful Projects

Local Roofing Experts

100% Guarantee

ICRS Public Adjusters Advocates For Policyholders

No Recovery, No Fee Representation*

We don’t get paid unless you do.

Proven Results

Successfully settled hundreds of millions in property damage claims.

Expert Representation

500+ large-loss claims settled fairly & promptly.

Avoid Unnecessary Litigation

We maximize settlements without unnecessary legal battles.

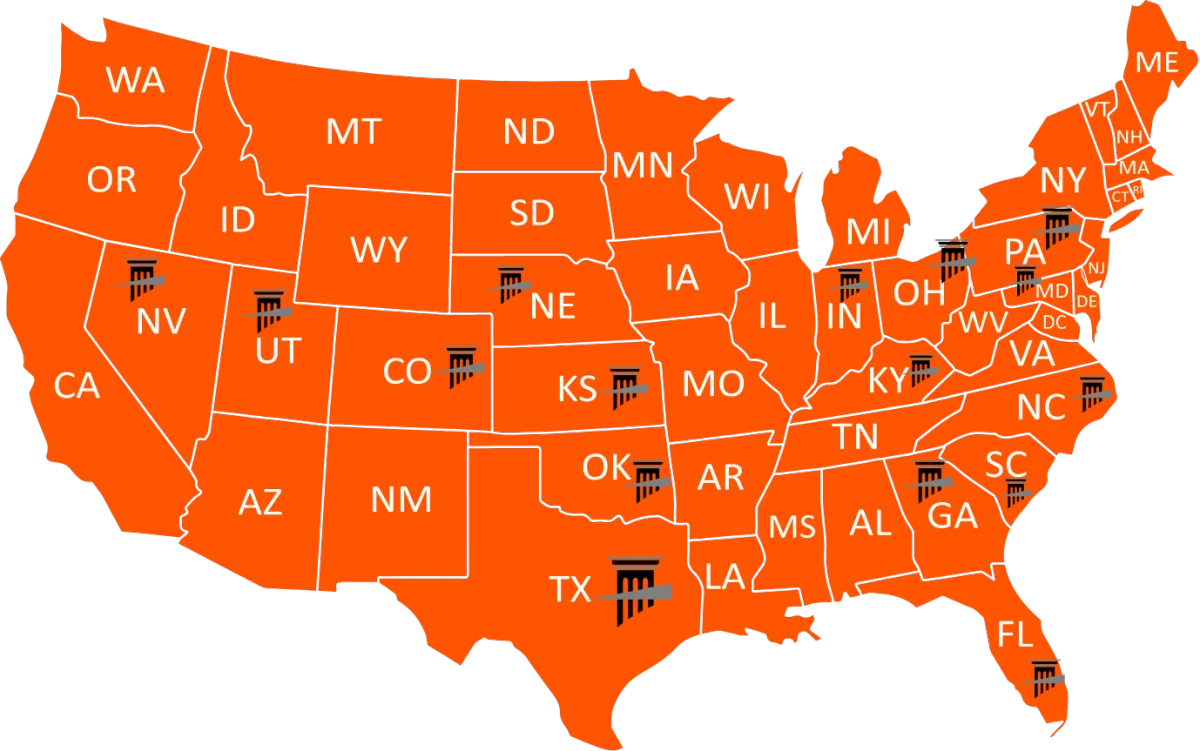

Licensed Public Adjusters Nationwide

We work exclusively for

policyholders, not insurers.

Verifiable Success

Increased settlements over initial offers by 20% to 3,830%+

Nation's Leading Tornado Damage Claim Specialist

Tornado Claim Denied or Underpaid?

If your claim has been delayed, denied, or lowballed, it's time to take action. Insurance carriers often dispute commercial tornado damage claims, but we have the expertise to prove the real extent of your losses.

Storm and wind damage

Public Adjusters for Commercial Buildings & Multifamily Structure Tornado Damage Claims

We Fight Insurance Tactics That Reduce Payouts

Helping Policyholders Recover Full Settlement

Find out if your claim was underpaid by scheduling a review today.

Licensed Public Adjusters In 16 States:

Serving tornado-prone states including

Texas, Oklahoma, Kansas, and the Midwest/South

If your commercial or multifamily property was impacted by a tornado, contact us immediately

.

Certified Commercial Roof Inspector

Premier Commercial Tornado Damage Claim Experts

Facing a complex commercial tornado claim? We ensure business owners recover maximum policy benefits with comprehensive documentation that insurance adjusters can't dispute.

Industry-Leading Specialists in Business Interruption & Property Damage Recovery

We Overturn Denied & Underpaid Tornado Insurance Claims

Why Choose ICRS TESTIMONIALS

Hear what Our Clients are saying

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

- Haidee J.

"I would highly recommend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

- James M.

"I came across this company and had none of those bad feelings"

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

- Katie H.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

Unsure If you need a public adjuster?

Frequently Asked Questions

What should I do immediately after a large-loss tornado claim?

After a tornado damages your property, take these critical steps:

Ensure everyone's safety and call emergency services

Contact your insurance company to report the claim

Document all damage with photos and videos before cleanup begins

Secure the property to prevent further damage

Save all receipts for emergency repairs and temporary relocation

Contact a licensed public adjuster before accepting any settlement offers

What qualifies as a "large-loss" tornado claim?

A large-loss torando claim typically involves:

Extensive structural damage requiring significant repairs

Business interruption losses exceeding $100,000

Complex coverage issues with multiple policy provisions

Commercial properties with specialized equipment or inventory

Claims where the estimated damage exceeds $250,000

What if my tornado damage claim was underpaid?

If you believe your fire claim was underpaid, you may still have options: For example, Texas law allows you to reopen and supplement claims within two years A licensed public adjuster can review your settlement and documentation We can identify overlooked damage. Our team can document additional losses and negotiate with your insurer We regularly increase settlements by 20% to 3,830% over initial offers We work on contingency, so there's no fee if we don't recover additional funds.

Can I dispute my tornado damage claim payout?

Yes, you have several options to dispute an insufficient tornado claim payout: Hire a public adjuster to document additional damages and negotiate on your behalf Request a formal claim review with your insurance company File a supplement claim with proper documentation of overlooked damages Request appraisal under your policy terms (we can represent you in this process) File a complaint with the Department of Insurance As a last resort, pursue legal action with an attorney specializing in insurance claims

Do I need a Public Adjuster if I have already received my settlement?

Yes, even if you have already received a settlement, a public adjuster can help determine if you were underpaid and whether you are entitled to additional compensation. Insurance companies often undervalue claims by overlooking damages, applying depreciation, or using restrictive policy interpretations. If your settlement does not fully cover the cost of repairs, you still have options.

Why Hire a Public Adjuster After Receiving a Settlement?

Settlement Review – A public adjuster can analyze your claim to ensure the insurance company accounted for all damages and provided a fair payout.

Supplemental Claims – If additional damage is found or your initial payout was insufficient, a public adjuster can negotiate for a higher settlement.

Reopening a Claim – Many policies allow claims to be reopened within a certain time frame, especially if new damages become evident.

Independent Damage Assessment – Insurance adjusters work for the insurance company, while a public adjuster represents your best interests.

When Should You Consider a Public Adjuster?

Your settlement does not fully cover repair costs.

You suspect the insurance company undervalued or missed damage.

You were told certain damage is not covered, but you are unsure if that is accurate.

You want an expert to handle negotiations and maximize your recovery.

Its best to act quickly with the best support by your side

Insurance policies often have strict deadlines for filing supplemental claims or reopening a claim. If you believe your hail damage settlement was too low, consulting a public adjuster could help you recover the full amount you are owed.

Get a Free Settlement Review Today.

AGENCY PUBLIC ADJUSTER LICENSES

MISTY'S PUBLIC

ADJUSTER LICENSES

SCOTT'S PUBLIC ADJUSTER LICENSES

Our Large Loss Specialties

Contact Us

LEGAL

Copyright 2025. ICRS LLC. All Rights Reserved.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.